Pakistan’s fragile fiscal caricature is facing its toughest test ever in a world scarred by geopolitical tensions, gyrating commodity prices, and shifting economic tides. With tight budgetary space and an increasing domestic expenditure requirement, the 2025 federal budget presented as a so-called “stabilization budget” provides little breathing space to a beleaguered economy. This blog navigates into the complexities of Pakistan’s budget in the wake of current international pressures. It points out underlying issues, external threats, a nd domestic engagements that make this financial roadmap a balancing act.

A Budget Born Out of Necessity, Not Vision

Budget 2025 for Pakistan was less than it was, and I was hobbled together. The lack of fiscal space was further accentuated by the IMF (International Monetary Fund), which pushed for fiscal discipline and a rise in government revenues. This year’s budget is not a statement of ambition, but of compulsion; it’s more about appeasing lenders than tending to the public.

To support the plan, the government has established that Our tax revenue will exceed Rs 12 trillion, a leap that was greeted with surprise in both business circles and the middle class. While taxing the salary class more, withholding tax being increased and the noose of indirect taxes spreading wider show a government trapped on the horns of need to survive but the fear of retribution.

Inflation and the Cost of Living Crisis

To the commoner in the street, budget numbers translate simply into his day-to-day existence. The inflation, which has stubbornly remained high, is further fueled by rising food, fuel, and electricity prices. This added to the strain of the removal of subsidies that was tied to the IMF conditions.

Now, the precarious middle class, long seen as the backbone of the country and global economy , is swept up in the financial squeeze. The households have seen a drastic shrinkage of budgets, and saving has become a remote possibility. “‘Austerity’ could be one of those buzzwords that Government ministers no longer subscribe to, but for the rest of us it’s a continuing, brutal reality.

Global Volatility: Pakistan’s Economic Achilles Heel

The budget was prepared amid several global flashpoints. The war between Russia and Ukraine continues to roil worldwide grain and energy markets, and tensions in the Middle East, particularly between Israel and Iran, are roiling oil prices.

These foreign pressures have ripple effects on Pakistan’s balance of payments, reserves, and currency stability. The Pakistani rupee is already weak and susceptible to global shocks. This leaves the country vulnerable to imported inflation and further restricts its economic alternatives.

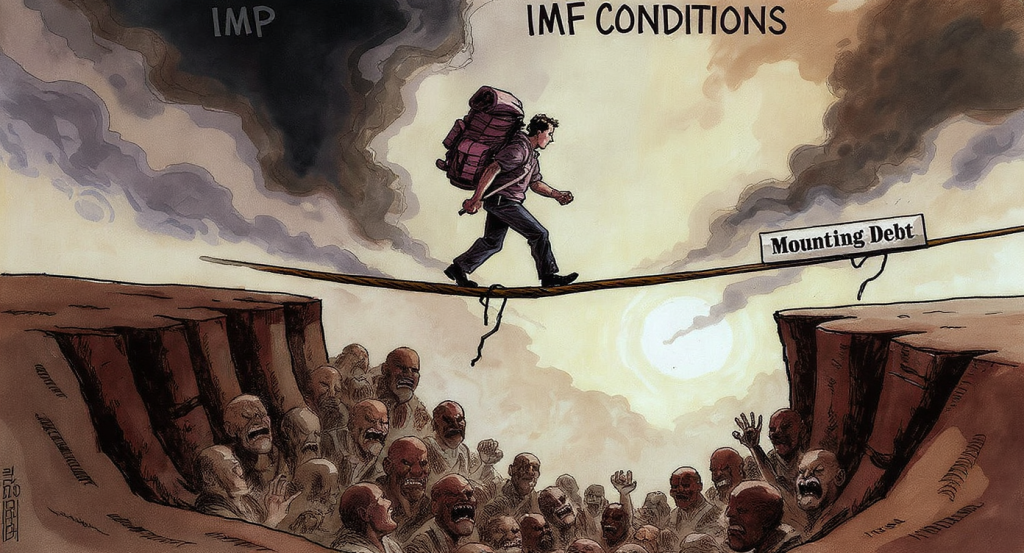

Mounting Debt and the IMF Tightrope

Pakistan’s debt is increasing at a ridiculous pace, which is unaffordable. As of mid-2025, the country still has an overall public debt ratio of approximately 78% of G.D.P. Servicing this debt takes up more than half of the government’s revenues. Under the pressure of IMF conditionalities calling for an increase in revenue mobilisation and the dilution of the amount to be spent, there is not much room for the government to make public investments.

The budget that has just been announced appears, on the face of it, designed to satisfy IMF indicators, taxes, fewer subsidies, and less development expenditure. But he and other governors still need to get it right: The long-term need category of infrastructure, education, and creating good jobs is taking a back seat.

Development Sacrificed at the Altar of Stability

On paper, budgets are supposed to be an embodiment of a vision of growth. What Pakistan’s 2025 budget looks like in practi.ce What has happened in reality is that Pakistan’s budget for 2025 looks more like a survival plan. Spending on development, especially social services, such as education, health, and clean water, has been sacrificed in order to pay the country’s debts and generate revenue.

The Public Sector Development Programme (PSDP) was reduced from Rs 950 billion to Rs 800 billion. Now, critical proj ts from energy, transportation and rural development are enduring delays or cancellations. This short-term mindedness may shore up balance sheets, but it does nothing for the nation’s long-term health.

Private Sector Concerns: Tax Fatigue and Uncertainty

The budget elicited a cautious disappointment from Pakistan’s business community. New taxes, especially for big businesses, banks, and exporters, risk further choking the already-slow pace of economic activity. Tax fatigue is a reality, and currency and policy uncertainties discourage domestic and foreign direct investments (FDI).

Digital record keeping and broadening the base may have been called for, but the impact remains on the one who complies, thereby building resentment and undermining confidence regarding movements bthe y government. And the ability of the private sector to create jobs and increase exports is still sharply constrained by the absence of real tax reform and the lack of incentives for growth.

A Bleak Outlook for the Common Man

Few ordinary Pakistanis have high hopes for this budget. Salaried employees face higher income taxes, utility bills rise again, and fuel subsidies will decrease. Meanwhile, in the real world, wages are stagnant, and jobs are few.

Smuggling is skyrocketing, particularly amongst the young and women. University graduates cannot find decent jobs, and small businesses are collapsing due to high input costs and power that is often unavailable. To many, migration now looks like the only way out.

Energy and Import Dependency: A Structural Weakness

The reliance of Pakistan’s economic model on energy imports is one of its most significant weaknesses. Despite possessing abundant potential solar and wind capacity, the nation still imports expensive fossil fuels. This year’s budget dedicates very little money to developing renewable energy, even though it’s a significant opportunity to reduce long-term costs and decrease our vulnerability to shocks in the global energy system.

In addition, the chronic trade gap, driven by significant import dependency and low-value exports, continues to be a problem. Pakistan’s export industry would be unable to compete with the rest of the world without structural reforms in agriculture, manufacturing, and logistics.

The Way Forward: Is There A Way Out?

But it’s not all doom and gloom. Pakistan continues to enjoy substantial human capital, a budding tech industry , and crucial geographic positioning. However, unlocking this potential will take radical policy shifts, not merely fiscal tinkering.

Here are the key areas that demand urgent attention:

- Tax Reform: The burden must be shifted from compliant to non-compliant sectors. Digital tracking, audit trails, and incentives for documentation can expand the tax base without punishing the already taxed.

- Education & Skills: Without investing in people, no economy can grow. Pakistan needs to prioritize education reform and vocational training.

- Renewable Energy: Cutting reliance on imported fuel can improve fiscal stability and environmental resilience.

- Export Diversification: Moving beyond textiles into IT services, pharmaceuticals, and agriculture tech can open new markets and bring in foreign exchange.

- Decentralized Governance: Local governments must be empowered to drive development based on regional needs, rather than top-down federal control.

Conclusion

Pakistan’s 2025 budget is not a transformation but a protection budget. But a perilously thin budget in a tumultuous world cannot bear the weight of a nation’s dreams eternally. Without vision, structural reforms, and strategies for inclusive growth, Pakistan may continue to be in this merry-go-round of financial firefighting. Change is urgent, in numbers and mindset. It is time for Pakistan’s policymakers to think beyond survival and chart a strategy of resilience, dignity, and sustainable progress.